Stockpile

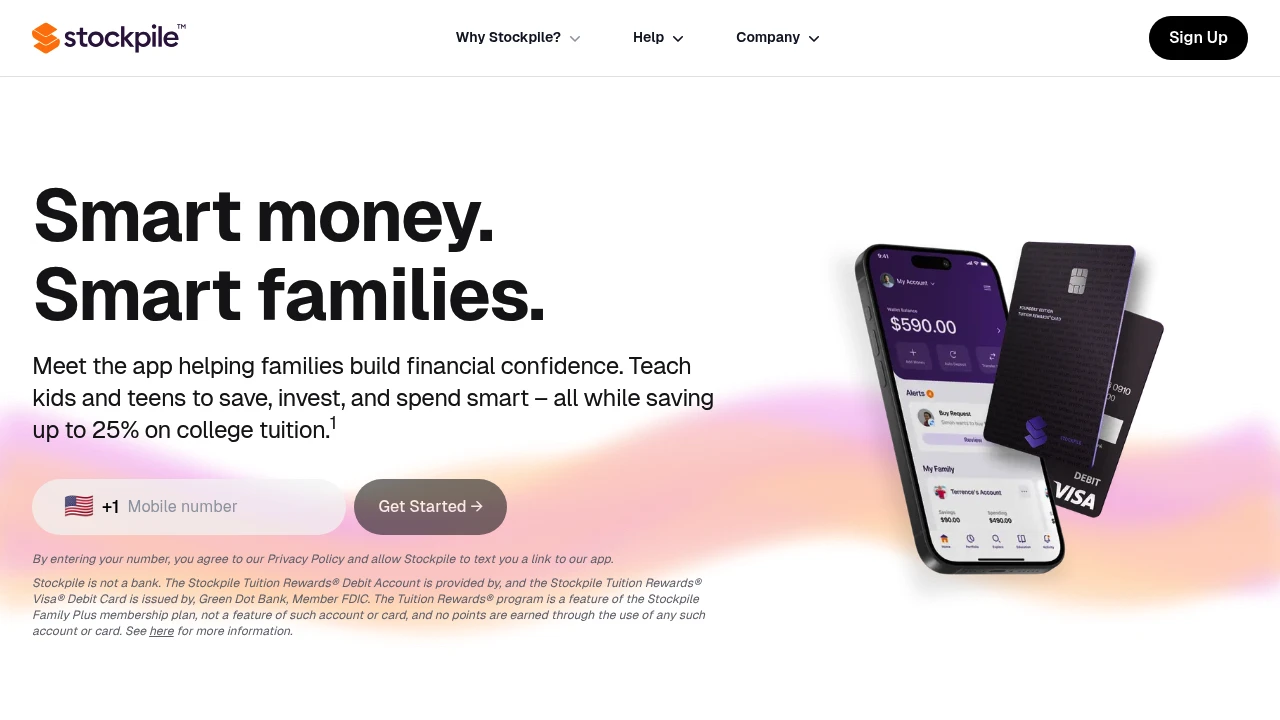

Mobile-first financial app for families that provides custodial investing, teen debit cards, savings vaults with APY, and a Tuition Rewards® program. Designed for parents and guardians who want to teach children under 18 practical money skills while maintaining oversight and access to investing and banking features.

What is Stockpile

Stockpile is a mobile-first financial app and family money platform that combines custodial investing, teen debit cards, and savings tools to help parents teach kids under 18 about saving, investing, and spending. The product suite includes custodial brokerage accounts, a deposit-style Tuition Rewards® Debit Account issued by Green Dot Bank (Member FDIC), and a Family membership model that unlocks tuition rewards and additional family features. Stockpile is not a bank for investments; investment custody and brokerage services are provided through partner clearing and advisory firms.

Stockpile positions itself for families with children and teens who want hands-on financial education: parents open the accounts and remain the legal custodians while kids gain limited independence via debit cards and investing permissions. The company highlights metrics such as over 1 million customers and a multi-billion‑dollar transaction history, and it reports an average Apple App Store rating of ★ 4.7 of 5 as of March 18, 2025. For legal and operational details, Stockpile partners with Green Dot Bank for deposit accounts and Apex Clearing Corporation for brokerage services.

The product is structured around three user needs: teaching money habits, enabling custodial investing, and offering a teen-friendly debit card tied to a savings vault that may earn interest. Families use Stockpile to channel allowance, gifts, and earned income into buckets where kids can invest in individual stocks or ETFs with low minimums, or hold cash in interest‑bearing savings vaults that are part of the Stockpile Tuition Rewards® Debit Account.

Stockpile features

Stockpile packages several distinct features aimed at families and custodial investing. Key features include custodial investing accounts, teen debit cards linked to a Green Dot-issued debit account, goal-based savings vaults, tuition rewards through the Tuition Rewards® program, parental controls, and educational content.

Core feature details:

- Custodial investing: Parents open custodial accounts for kids under 18 and may purchase fractional shares or whole shares across thousands of stocks and ETFs with low minimum purchases (investing from $5 increments is supported). Brokerage services are provided by Apex Clearing Corporation and investment advisory services are provided by Stockpile Investment Advisors, Inc. where registered.

- Debit card & savings vaults: The Stockpile Tuition Rewards® Visa® Debit Card and associated deposit accounts are issued by Green Dot Bank, Member FDIC. The platform offers a savings vault that has paid interest at promotional rates — Stockpile has advertised a 4.00% APY on savings vaults as of August 28, 2025 — subject to terms and account standing. Interest is paid monthly on the average daily balance in the vault and reported under the adult owner's Social Security number.

- Parental controls and educational tools: Guardians control trading permissions, transfer money to kids, set chore or allowance flows, and monitor activity. The app includes educational prompts and in‑app experiences to introduce stock concepts and goal-tracking.

- Tuition Rewards® program: Available through the Family Plus membership, Tuition Rewards® points can be earned and redeemed at participating colleges; the program is provided by SAGE CTB, LLC and Tuition Rewards® is a registered trademark of SAGE Scholars, Inc. Stockpile advertises the potential to save up to 25% at participating colleges depending on rewards and institutional participation. Visit Tuition Rewards® for program specifics.

- Account protections and legal structure: Deposit accounts issued through Green Dot Bank are FDIC‑insured up to regulatory limits. Securities and brokerage assets are not FDIC-insured and are protected under SIPC rules (details at the SIPC website). Stockpile Investment Advisors, Inc. is an SEC-registered investment adviser; registration does not imply a specific skill level.

Operational features and limits:

- Account opening requires identity verification, including Social Security number for the adult owner, and mobile verification for many features. Certain services require a Stockpile Investing Account and a Stockpile Membership Deposit Account to be opened and approved.

- ATM usage and cash withdrawal limits apply; Stockpile lists 1 free ATM withdrawal per monthly statement period, then $3.00 per withdrawal thereafter at network locations with additional out-of-network fees possible.

- Gift card purchases on the platform require a valid debit card and cannot be paid for with credit cards, cash, checks, or standalone mobile wallet methods unless linked to a debit card.

What does Stockpile do?

Stockpile enables families to teach financial skills by combining custodial investment accounts with spending and saving tools for kids and teens. Guardians can deposit money, assign chores or allowances, and let kids direct funds toward savings goals, stock purchases, or everyday spending with a debit card. The investing experience is simplified for younger users: fractional shares, curated lists, and kid-friendly explanations make stock ownership accessible.

Operationally, Stockpile separates banking and brokerage functions. The deposit side (debit card and savings vault) is provided by Green Dot Bank while investment accounts and advisory services are handled by affiliated broker and adviser entities. That separation means deposits may be FDIC-insured while securities holdings are SIPC-protected within the limits SIPC provides, and are subject to market risk.

Stockpile also offers membership tiers that unlock different benefits, notably Tuition Rewards® for tuition savings, which is a distinct program run by SAGE CTB, LLC. This makes Stockpile relevant both as a day-to-day money tool (debit card + savings) and as a longer-term education- and investment-oriented product for families preparing for college costs.

Stockpile pricing

Stockpile offers these pricing plans:

- Family Base: $4.95/month or $47.45/year (annual billing). Requires opening a Stockpile Investing Account and a Stockpile Membership Deposit Account.

- Family Plus: $9.95/month or $83.40/year (annual billing). Includes access to the Stockpile Tuition Rewards® program and additional membership benefits; requires opening the Stockpile Tuition Rewards® Debit Account for kids who will receive cards.

Additional costs and fees to expect:

- Brokerage-related regulatory fees (SEC and TAF) apply to trades as required by regulators and are listed as pass-through charges.

- ATM fees: 1 free ATM withdrawal per monthly statement period, $3.00 per withdrawal thereafter at in-network locations, and $3 for out-of-network withdrawals plus any ATM owner fee.

- Retail service fees, limits on gift card purchases, and standard debit-card network fees may apply; retail gift-card purchases have a service fee up to $4.95 in some cases.

- Investment custody and trading are subject to market risk and may include brokerage execution considerations; advisory fees apply only to clients of registered advisory services when applicable.

Stockpile publishes promotional APYs and occasional partner offers; for example, the app advertised a 4.00% APY on savings vaults as of August 28, 2025, subject to change and account terms. Stockpile also advertises Tuition Rewards® point opportunities that equate to potential tuition discounts — membership details, eligibility, and point accrual are governed by SAGE CTB, LLC and Stockpile's membership terms.

Check Stockpile's current pricing plans (https://stockpile.com/pricing) for the latest rates and product details. Visit their official pricing page for the most current information.

How much is Stockpile per month

Stockpile starts at $4.95/month for the Family Base membership when billed monthly. The Family Plus membership is $9.95/month when billed monthly and includes Tuition Rewards® eligibility and other Family Plus benefits.

Monthly billing allows families to try membership features without committing to a full year, but annual billing provides a lower effective cost for both tiers. Additional transaction fees (ATM withdrawal fees, regulatory fees on trades, retail purchase service fees) may apply depending on usage.

How much is Stockpile per year

Stockpile costs $47.45/year for Family Base when billed annually. Family Plus costs $83.40/year when billed annually. Annual billing effectively reduces the total cost compared to monthly billing; for example, Family Base annual billing represents about a 20% reduction versus paying $4.95/month for 12 months.

These membership fees cover family features and access to the platform; other fees (banking and trading regulatory fees, certain ATM or retail service fees) are charged separately as applicable.

How much is Stockpile in general

Stockpile pricing ranges from $4.95/month to $9.95/month for consumer family membership tiers, with annual equivalents of $47.45/year and $83.40/year respectively. Beyond membership fees, users should budget for occasional ATM fees, trade regulatory charges, and any retail service fees for specific purchase types such as gift cards.

Families should also account for investment-related costs like trade fees or advisory fees if they opt into paid advisory services, and for potential tax consequences of interest earned or investment gains. For the latest detailed fee schedule and any promotional pricing, check Stockpile's membership and fee disclosures.

Visit their official pricing page for the most current information.

What is Stockpile used for

Stockpile is used to teach financial literacy and create practical money experiences for minors through hands-on saving, investing, and spending. Parents and guardians use Stockpile to:

- Move allowance or gift money into savings vaults and investing accounts for kids.

- Give controlled spending power via a Visa® debit card for authorized teen users while retaining oversight and controls.

- Introduce investing with fractional-share purchases and simple explanations so children learn market concepts early.

It is also used as a family financial hub where parents can monitor activity, review progress toward goals, and run chore or allowance programs. For families planning for college, Stockpile's Family Plus membership integrates Tuition Rewards® points, which are redeemable at participating colleges and may reduce tuition costs in specified ways.

Finally, Stockpile is used by families who want to combine both short-term cash management (savings vaults and debit card) and longer-term investing (custodial brokerage) in one app without needing separate providers for teen banking and custodial investing.

Pros and cons of Stockpile

Pros:

- Consolidates custodial investing, teen debit cards, and savings vaults in a single mobile app that is oriented to family use and education.

- Low minimums for investing (fractional shares and small-dollar purchases), which lower the barrier for kids to own real stocks and ETFs.

- Tuition Rewards® integration on Family Plus memberships provides a structured path to earn college tuition discounts at participating institutions.

- Clear custodial structure: parents retain legal control while children learn to manage money in a supervised environment.

Cons:

- Membership fee required for Family Base/Plus; no widely advertised fully free membership tier that includes Tuition Rewards® benefits, so families who prefer free services might look elsewhere for basic teen accounts.

- Certain features and deposit accounts are provided by third parties (Green Dot Bank, Apex Clearing), which adds complexity around what is FDIC‑insured versus what is brokerage (SIPC) protection.

- Fees for ATM out-of-network withdrawals and some retail transactions can add up for active teen spenders; some gift-card purchases include service fees.

- Not all colleges participate in Tuition Rewards®, and the maximum advertised 25% tuition reduction depends on the institution and reward level; families should verify participating colleges and program rules with SAGE CTB, LLC.

Practical considerations:

- Stockpile is best-suited for families who want to combine investing education with debit-card spending and who are comfortable paying a modest membership fee for managed family features.

- Families primarily seeking a no-frills custodial brokerage without banking features may find lower-cost brokerage-only custodial accounts elsewhere.

Stockpile free trial

Stockpile does not typically advertise a standard time-limited free trial that unlocks Family Plus Tuition Rewards® benefits; instead, the platform offers account sign-up with membership tiers billed monthly or annually. Some basic functionality — such as browsing the app, viewing educational content, and exploring investing options — can be accessed without immediately committing to an annual plan, but to receive full membership features you must open the required accounts and pay the membership fee for the selected tier.

Because membership fees are modest ($4.95/month or $9.95/month) families often evaluate the service using a single month of membership before switching to annual billing for savings. Stockpile's onboarding process includes account verification steps (mobile number, identity verification, and Social Security number for the adult owner) that are required for active debit and deposit features.

For the most current information on trials or promotional offers, check Stockpile's membership terms or contact support at support@stockpile.com or via the Stockpile help center (https://stockpile.com/help).

Is Stockpile free

No, Stockpile requires a paid membership for full family features. Core family membership tiers start at $4.95/month (Family Base) or $9.95/month (Family Plus) when billed monthly, with lower annual pricing available for either tier. Some simple browsing and educational resources can be accessed without an active membership, but the full set of family features, including Tuition Rewards® eligibility, requires the applicable paid plan and approved accounts.

Stockpile API

Stockpile does not publicly market a consumer-facing, open trading API for retail customers to automate trades. Brokerage and custody operations are handled through partners such as Apex Clearing Corporation, and Stockpile Investment Advisors, Inc. provides advisory services where registered. Companies that require programmatic access for large-scale integrations or enterprise relationships should contact Stockpile's business or developer relations through official support channels.

Developers and partner businesses interested in integrations should reference the Stockpile help center and developer or partner pages for official partnership routes. For custody and broker/dealer operational details, consult Apex Clearing Corporation and Stockpile's regulatory disclosures and the SIPC protections described on www.sipc.org.

10 Stockpile alternatives

Paid alternatives to Stockpile

- Greenlight — A family banking app with teen debit cards, parental controls, and investing options; includes chore and allowance automation and different fee tiers for families.

- Acorns — Micro-investing app that rounds up purchases into investment accounts and offers custodial accounts for kids via Acorns Early; focuses on automated portfolio investing and recurring contributions.

- BusyKid — A chore, allowance, and debit card system that teaches kids financial responsibility with options to invest earnings in stocks through the platform.

- FamZoo — Prepaid family accounts and virtual cards designed for chores, allowances, and teaching financial literacy with strong budgeting and ledger tools.

- GoHenry — Teen debit cards and parental controls oriented to U.K. and U.S. families with allowance automation and spending rules.

- Step — Teen banking with spending and direct‑deposit features, early access to paychecks, and tools designed for teens and parents; focuses on banking rather than investing.

- M1 Finance — Not family-focused exclusively, but offers fractional-share investing and automated portfolio features that some families use for custodial investing.

Open source alternatives to Stockpile

- Firefly III — An open source personal finance manager for tracking budgets, accounts, and goals; requires self-hosting and does not provide brokerage or banking integrations out of the box.

- GnuCash — Desktop double-entry accounting software that families can use to model budgets and track allowances manually; no integrated brokerage or teen debit card.

- KMyMoney — Personal finance manager with account tracking and budgeting features suitable for individuals and families who prefer a local, open-source solution.

- Money Manager Ex — A lightweight, cross-platform personal finance tool for tracking spending, budgets, and accounts; requires manual entry and external banking integration tools.

Open source alternatives require more setup and do not provide custodial brokerage, teen debit cards, or Tuition Rewards®-style programs. They are better suited for families that want full control of data and are comfortable self-hosting or manually reconciling accounts.

Frequently asked questions about Stockpile

What is Stockpile used for?

Stockpile is used to teach children and teens how to save, invest, and spend under parental supervision. Families use it to open custodial investing accounts, issue teen debit cards, set savings goals, and earn Tuition Rewards® through eligible membership tiers. The platform combines banking-style deposit accounts and brokerage investing tools tailored to parents and young users.

How does the Stockpile debit card work?

The Stockpile Tuition Rewards® Visa® Debit Card is issued by Green Dot Bank and functions like a standard Visa debit card. The card links to the Stockpile Tuition Rewards® Debit Account and can be used for everyday purchases subject to ATM and merchant fees; parental controls and spending visibility are available through the app. Card issuance and deposit account terms are governed by Green Dot Bank (Member FDIC).

Does Stockpile offer custodial investing accounts?

Yes, Stockpile offers custodial investing accounts for minors under 18. Parents or guardians open and control the accounts while children can learn by making restricted trades, buying fractional shares, and tracking investments. Brokerage services are provided in partnership with Apex Clearing Corporation and advisory services via Stockpile Investment Advisors, Inc. where applicable.

Can Stockpile funds be FDIC-insured?

Deposits held in the Stockpile Tuition Rewards® Debit Account are FDIC-insured through Green Dot Bank up to applicable limits; however, securities and investment holdings are not FDIC-insured and are protected under SIPC coverage where eligible. Check Green Dot Bank and SIPC disclosures for precise insurance and protection details.

Is Stockpile safe for children to use?

Stockpile provides parental controls and custodial account structures designed for safety and oversight. Parents maintain legal custodial ownership and control major functions while kids can make limited trades and use a debit card under configured limits. Security features and partner protections (FDIC for deposits, SIPC for securities) apply according to the underlying service provider terms.

Why does Stockpile have membership fees?

Stockpile charges membership fees to unlock family features, account access, and the Tuition Rewards® program. Membership tiers (Family Base and Family Plus) pay for platform features such as custody, parental controls, and rewards program participation; additional bank and transaction fees may still apply depending on usage.

When do Tuition Rewards® points apply and how much can they save?

Tuition Rewards® points are earned through a Family Plus membership and are provided by SAGE CTB, LLC. Points translate into discounts at participating colleges and Stockpile advertises potential savings up to 25% at some participating institutions; the exact benefit varies by institution and program rules. Families should review Tuition Rewards® eligibility and college participation on the Tuition Rewards® site.

Where is Stockpile available?

Stockpile primarily serves U.S.-based customers and issues deposit accounts through a U.S. bank partner. Product availability, card issuance, and regulatory protections are tied to U.S. banking and brokerage partners; international availability may be limited and subject to local regulations.

How do I contact Stockpile support?

You can contact Stockpile via email at support@stockpile.com or by phone at 877.374.2584. The company also maintains a help center with articles and support routes on its website (https://stockpile.com/help) for common account and product questions.

Does Stockpile provide an API for developers?

Stockpile does not publish a public consumer trading API; partner or enterprise integration requests are handled through official channels. Brokerage and custody functions are routed through partner firms, so businesses that need programmatic access should contact Stockpile's business or developer relations to discuss partnership options.

Stockpile careers

Stockpile hires across product, engineering, design, compliance, marketing, and customer support functions with offices based in San Francisco as of 2025. Jobs typically emphasize experience in fintech, consumer mobile product development, and regulatory compliance, especially given the company's mix of banking, brokerage, and advisory relationships. Candidates should expect interview rounds covering technical skills, product thinking, and domain knowledge in financial regulations and consumer protection.

For current openings and recruitment details, check Stockpile's careers resources or company listings on major job platforms. Stockpile's public filings, press releases, and LinkedIn page can also provide insight into hiring priorities and company growth areas.

Stockpile affiliate

Stockpile runs partnerships and referral programs that change over time; affiliates and partners may be able to earn referral fees or special enrollment offers for new customer signups depending on promotional terms. The Tuition Rewards® partnership is a distinct affiliation with SAGE CTB, LLC and involves separate terms for reward accrual and redemption.

Affiliates interested in formal programs should contact Stockpile's partnerships team through the help center or corporate contact points to inquire about available affiliate programs, API/partner integrations, and promotional terms.

Where to find Stockpile reviews

Stockpile reviews are available on major app stores and financial review sites. The Apple App Store lists Stockpile with an average rating of ★ 4.7 of 5 with over 55,000 reviews as of March 18, 2025. Users can also find reviews and family-case studies on fintech review sites and publications that cover kids-and-banking products.

When evaluating reviews, compare comments about costs, parental controls, card functionality, savings APY, and customer support responsiveness. For regulatory and technical disclosures, consult Stockpile's help center and legal documents.